arizona charitable tax credits 2020

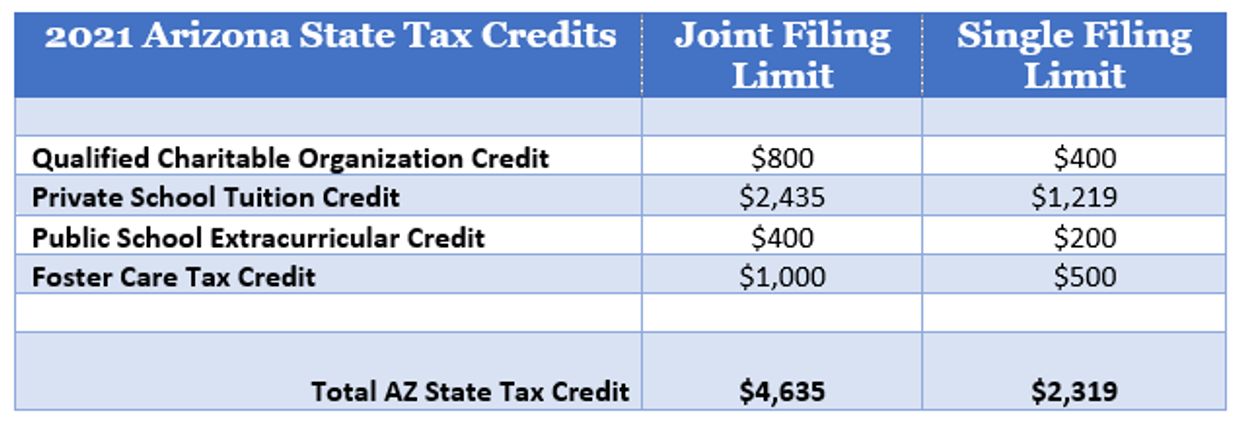

Through the Arizona Charitable Tax Credit you can receive a credit on your Arizona tax liability up to 400 individually or 800 for couples filing jointly. A couple filing a joint return in Arizona can qualify to redirect as much as 4965 for 2020.

Printable Arizona Income Tax Forms For Tax Year 2021

The Arizona Department of Revenue ADOR advises taxpayers they have until May 17 to make donations to qualifying charitable organizations to claim the tax credits on their 2020 individual income tax return.

. Name of Organization Address QCO Code Qualifying organizations for cash donations made between January 1 2021 and December 31 2021 20842 Arizona Behavioral Health Corp. Qualifying organizations for cash donations made between January 1 2020 and December 31 2020 22230 15 Hands Hearts Inc 8380 N Fleming Dr Flagstaff AZ 86004 928 310-0947 20266 1st Way Pregnancy Center PO Box 5294 Phoenix AZ 85016 602 261-7522. You can provide free healthcare for those in need at no cost to you.

Unused amounts of credit carry forward for five years except for the military credit which does not carry forward. SCNM Sage Foundation is a Qualified Charitable Organization QCO eligible for the Arizona Charitable Tax Credit. Below youll find links to information and donation pages for six different AZ eligible tax credit options.

The state of Arizona provides a variety of individual tax credits including the Arizona Charitable Tax Credit and the Public School Tax Credit. 2020 limits are quoted. For all of them you have until April 15 2021 or until the date you file your return if you do so early to donate for the 2020 tax year.

February 5 2020 311 PM. A Modern Logo For A Real Estate Company Realestate Logodesign Zilliondesigns Logo Design Collection Custom Logo Design Custom Logos. 1406 N 2nd Street Phoenix AZ 85004 20063 Arizona Brainfood PO Box 242 Mesa AZ 85211 20667 Arizona Burn Foundation 1432 N 7th Street Phoenix AZ 85006 20873 Arizona Cancer.

Arizona provides two separate tax credits for those who make contributions to. Arizona Credit for Donations Made to Qualifying Charitable Organizations QCO Contribution amounts eligible for credit. Any credits for charitable contributions to Qualifying Charitable Organizations QCOs and Qualifying Foster Care Charitable Organizations QFCOs not claimed in a tax year carry forward up to five years.

There are four major tax credits that you can use to offset certain charitable donations in Arizona. Private School Tuition Credits which must be paid on or before Dec. February 16 2020 206 PM.

A taxpayer can contribute and take all the credits subject to the amount of state tax for any particular year. Your dollar-for-dollar tax credit donation to a Qualified Charitable Organization will support organizations assisting low income children individuals and families. Arizona charitable tax credits 2020 Thursday March 17 2022 Edit.

The state of Arizona provides a variety of individual tax credits including the Arizona Charitable Tax Credit and the Public School Tax Credit. However the deadline for Arizonans to make charitable contributions and qualify for state income tax credit is today April 15th. The 2020 Definitive Guide to the Arizona Charitable Tax Credit Everything you need to know to take advantage of the Arizona Charitable Tax Credit in 2020 updated for the 2019 tax year.

The 2022 Definitive Guide To The Arizona Charitable Tax Credit. Arizona provides two separate tax credits for individuals who make. 800 Married filing jointly.

Rules for Claiming Arizona Tax Credits for Donations. List of Qualifying Charitable Organizations for 2020. Everything you need to know to take advantage of the Arizona Charitable Tax Credit updated for the 2021 tax year.

31 2020 must be paid on. For the Arizona Credit for Contributions to Charitable Organizations Form 321 only Cash Donations qualify. Qualifying Charitable Organizations and Qualifying Foster Care Charitable Organizations.

Contributions in all other categories except the S. Information about qualifying as a Qualifying Charitable Organization  Qualifying Foster Care Charitable Organizations AZ Form 352 A credit of up to 1000 for couples filing jointly and 500 for all other filers is available for contributions to a qualified foster care charitable organization. Charitable Taxpayers can claim charitable contributions to Private School Tuition Organizations made through payroll withholding and this tax credit has a five year carryover period.

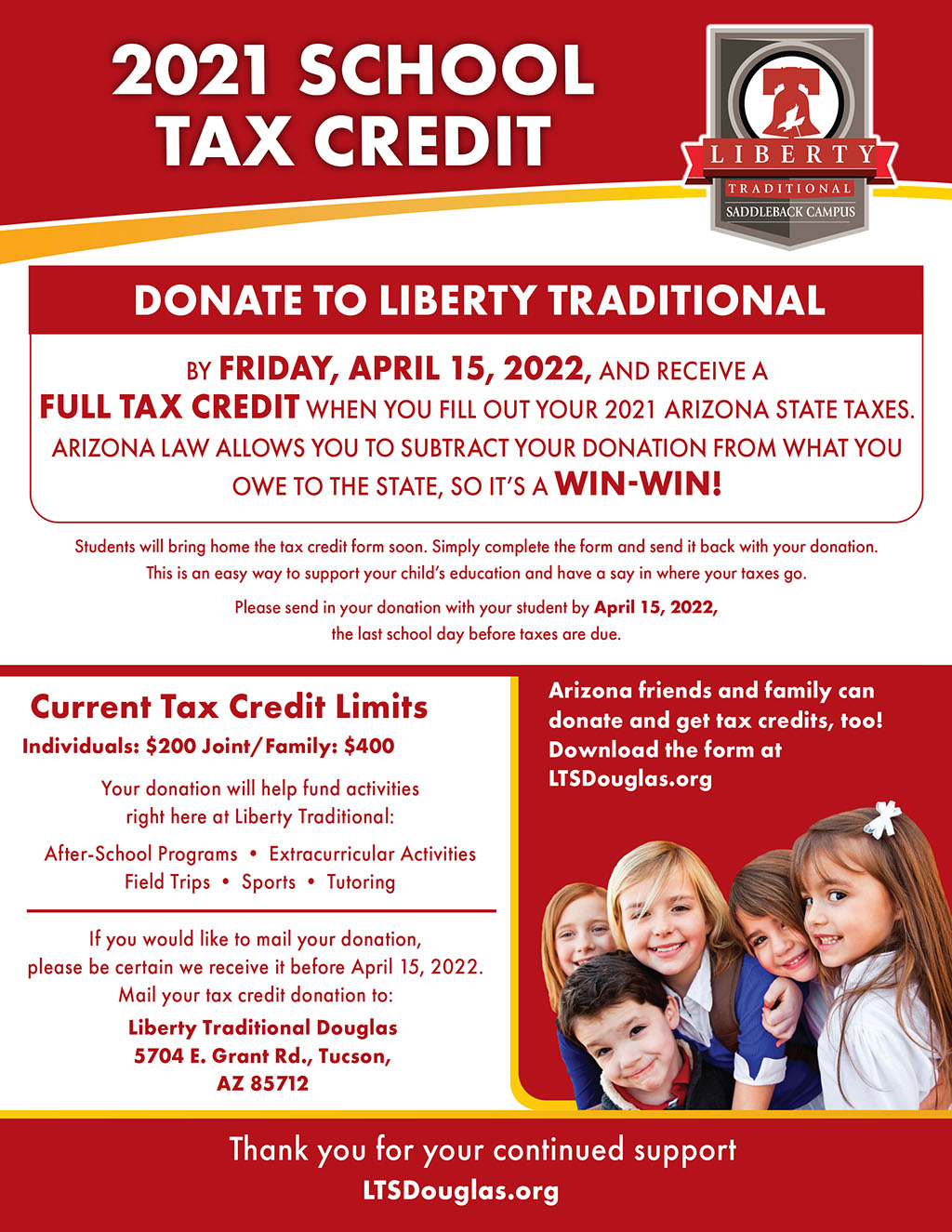

Click the link for detailed info at the Arizona Dept. Like the Arizona Charitable Tax Credit the deadline for making a charitable contribution for the 2021 tax year under the Private School. Due to the COVID-19 outbreak the deadline for filing and paying State and Federal income tax has been extended from April 15th 2020 until July 15th 2020.

The Arizona Charitable Tax Credit is a dollar-for-dollar tax credit that reduces the taxpayers tax liability what is owed for AZ state taxes. The credits are non-refundable. 400 for single filers 800 for joint.

These tax credits allow. ARIZONA CHARITABLE TAX CREDITBig Brothers Big Sisters of Southern Arizona SOAZBIGS is a Qualified Charitable Organization QCO code 20461 for the Arizona. These tax credits allow taxpayers to make charitable contributions and receive dollar-for-dollar reductions in their Arizona state.

Tax Credit Liberty Traditional Schools Saddleback Douglas Charter School

Arizona Charitable Tax Credits Robyn D Young Cpa Llc

Az Standard Deduction Increase For Charitable Contributions

Complete Your 2021 Arizona And Irs Taxes Now On Efile Com

Why Do Grocery Stores Ask For Donations Tax Breaks

Workplace Giving Mesa United Way

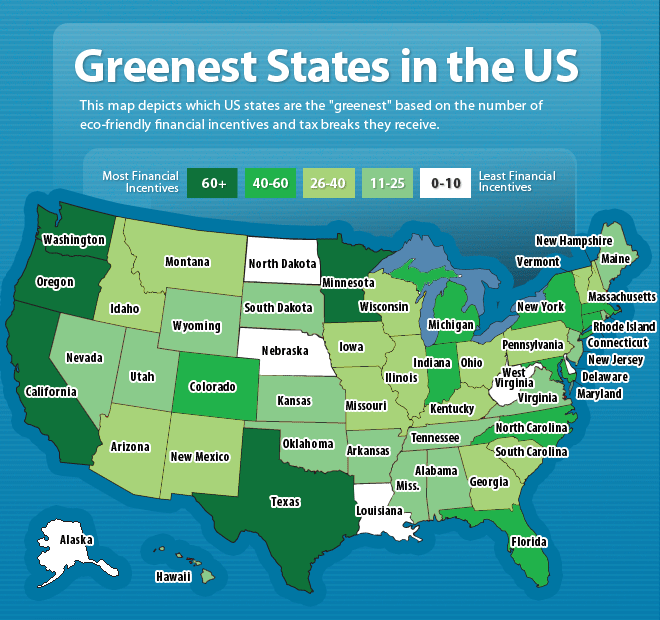

America S Greenest States Turbotax Tax Tips Videos

State Of Arizona Extends Tax Credit Deadline To May 17th Ibe

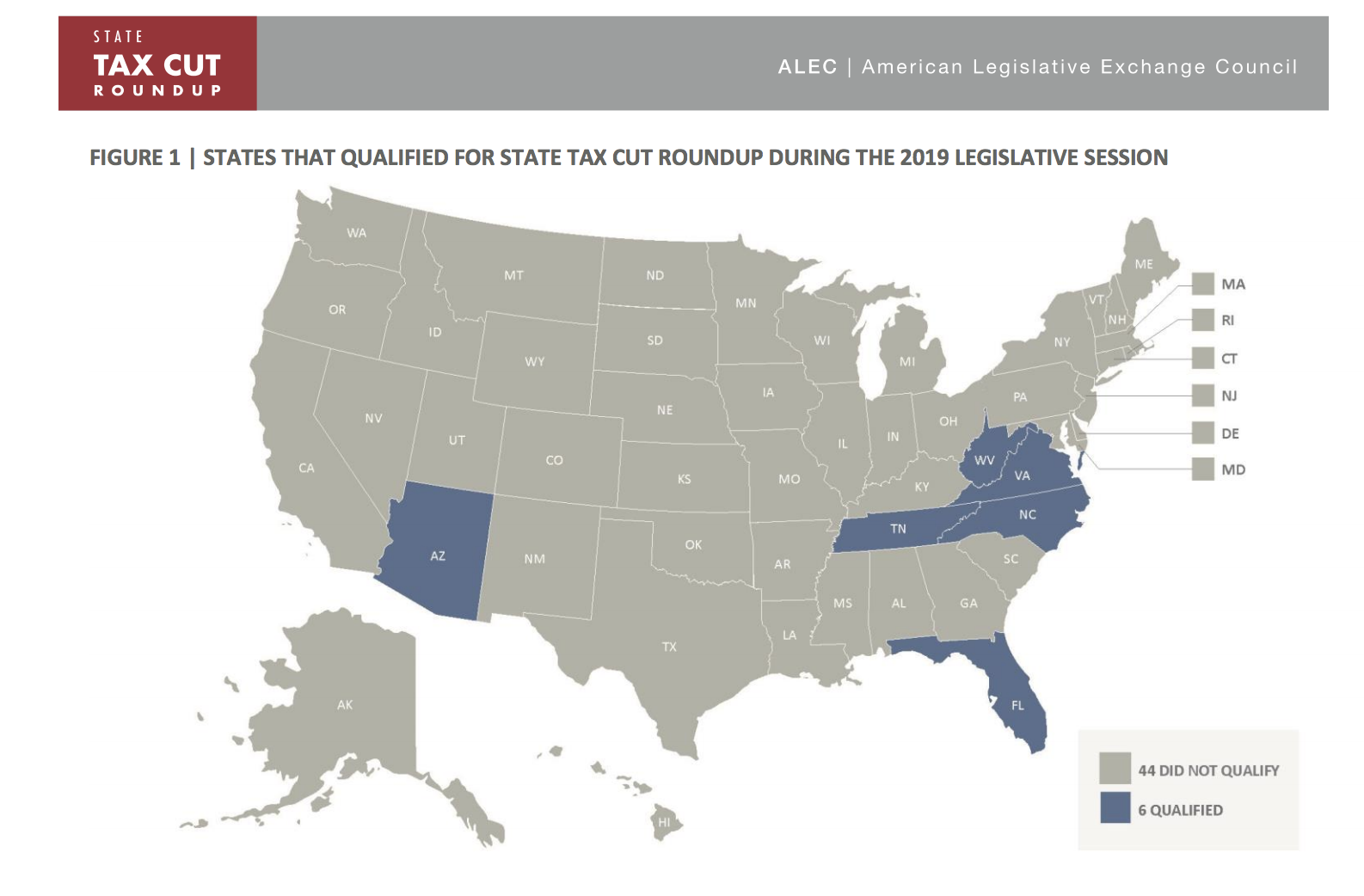

Report Arizona Leads In Tax Relief Office Of The Arizona Governor

The 2021 Guide To Charitable Ira Rollover Donations Phoenix Childrens Hospital Foundation

Report Arizona Leads In Tax Relief Office Of The Arizona Governor

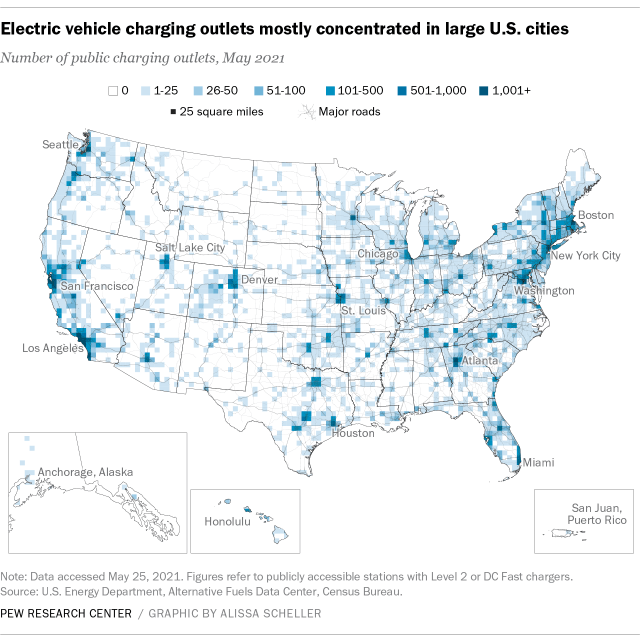

Electric Vehicle Market Growing More Slowly In U S Than China Europe Pew Research Center